Ukraine Monitor

economic and social impacts

Views/information on resilience or disruption of supply chains due to the Russian invasion in Ukraine and various sanctions

11 May 2022

Energy

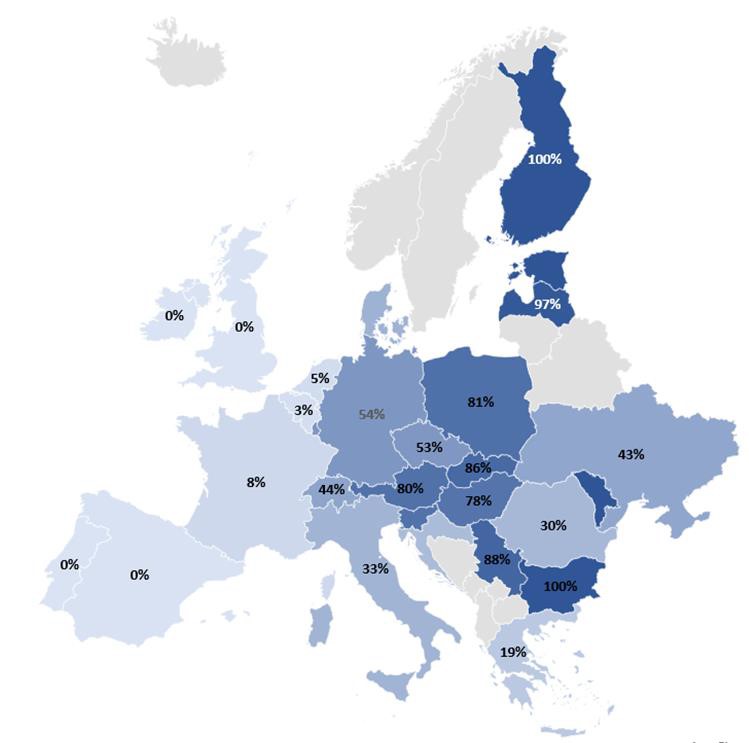

The share of Russian pipeline gas in EU gas imports was 41% in 3Q 2021 and the share of gas transiting through Ukraine to the EU reached 25% in 2021

The EU's dependence on energy imports has increased in recent years due to the decline in non renewable energy production in several European countries, combined with stable energy demand.

- Portugal and Spain use little Russian energy, while Germany relies on natural gas for more than half of its supply and oil for more than 30 France is more independent thanks to nuclear power, but it depends on Russia for its fossil fuel needs

Although two pipelines have been built (Nord Stream 1 in 2012 and Nord Stream 2 in 2021 bypassing Eastern European countries, Gazprom owns 51 of NS 1 and is the sole shareholder in NS 2

- On 22 02 2022 the German government suspended the licensing process for NS 2 due to the conflict between Russia and Ukraine

The future of gas supplies from Russia is becoming uncertain and further developments are possible

- interruption of deliveries for political reasons

- uncertainty over energy payments as part of the sanctions imposed on Russia

- damage to Ukrainian pipelines

The EU has decided to strengthen and accelerate the implementation of the European Green Deal investment program so as to substitute fossil fuel imports from Russia

Gas storage: the regulation of the gas market is currently under review in the European Parliament* but the procedure could be sped up to minimize the impact of the possible consequences of the conflict.

- Currently, storage tanks are about 30 full, but efforts to increase this can be expected

- The countries with the largest storage capacity in the EU are Germany, Italy, the Netherlands and France

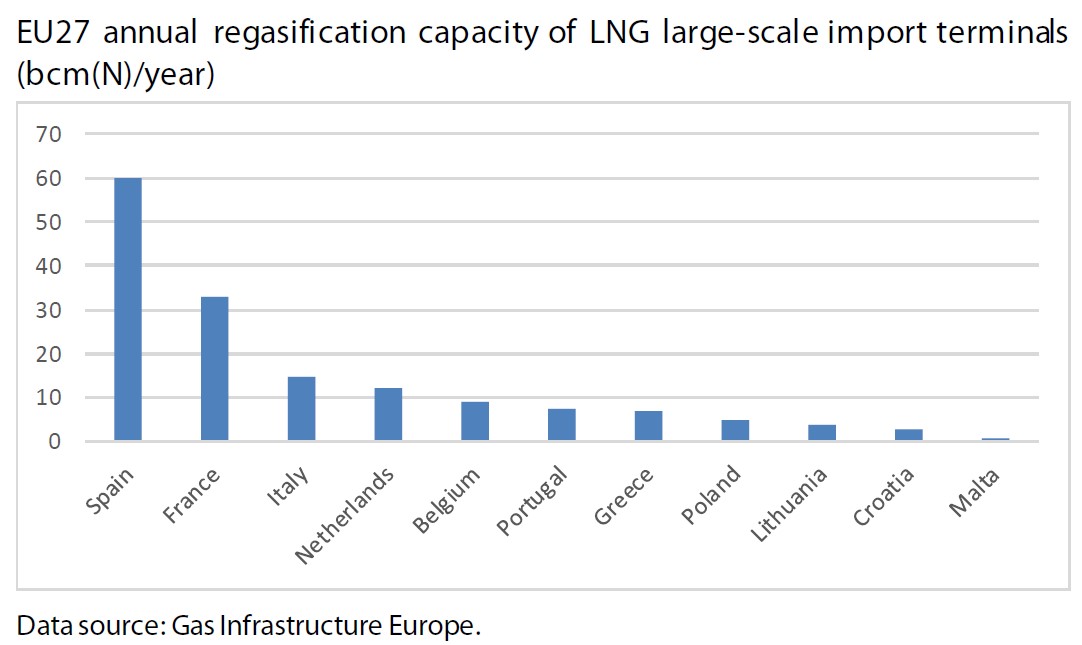

Potential use of LNG: in the eventuality of Russian natural gas supplies being cut off, although the price is significantly higher.

- The EU 27 currently has a total annual import capacity of 156 bcm .

- Spain and France would be the main players due to its capacity and trade links with other partners outside Russia

Development of renewable energy, promotion of energy efficiency and infrastructure development.

(*) European Commission 2021 December) Proposal on common rules for the internal markets in renewable and natural gases and in hydrogen COM( 2021 803; final European Commission 2021 December) Proposal on the internal markets for renewable and natural gases and for hydrogen ( COM( 2021 804 final.

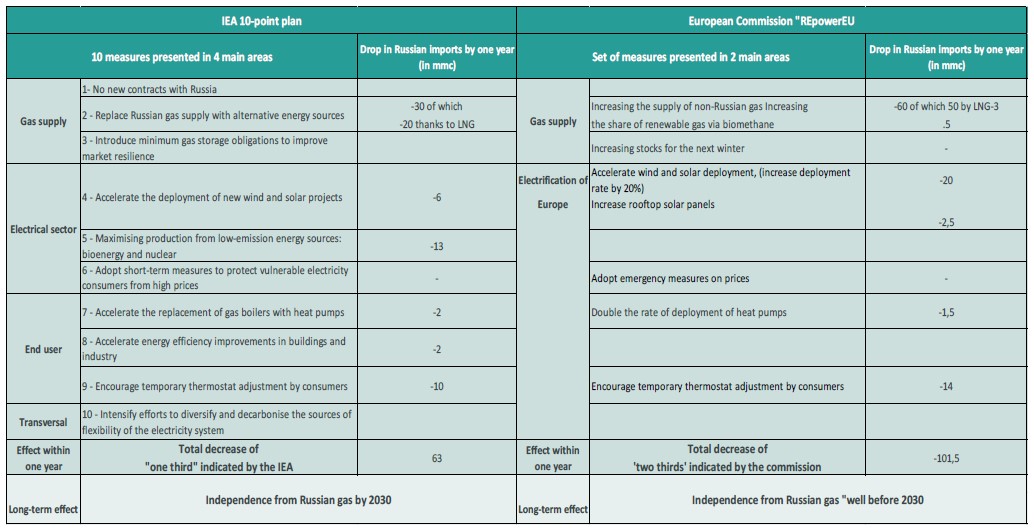

Initiatives to tackle dependency on Russian Gas

The European Commission (EC) presented on 8 March the "REpowerEU " plan, which aims to reduce Russian gas imports by two thirds within a year; a final version of the plan is expected at the end of May. This proposal is more ambitious than the one proposed on 3 March by the International Energy Agency